Electronic Business Identification Number (E-BIN) registration is essential for businesses in Bangladesh to operate legally and engage in VAT-related activities. Kamal Associates BD must obtain an E-BIN through the National Board of Revenue (NBR) by applying online via the VAT Online System.

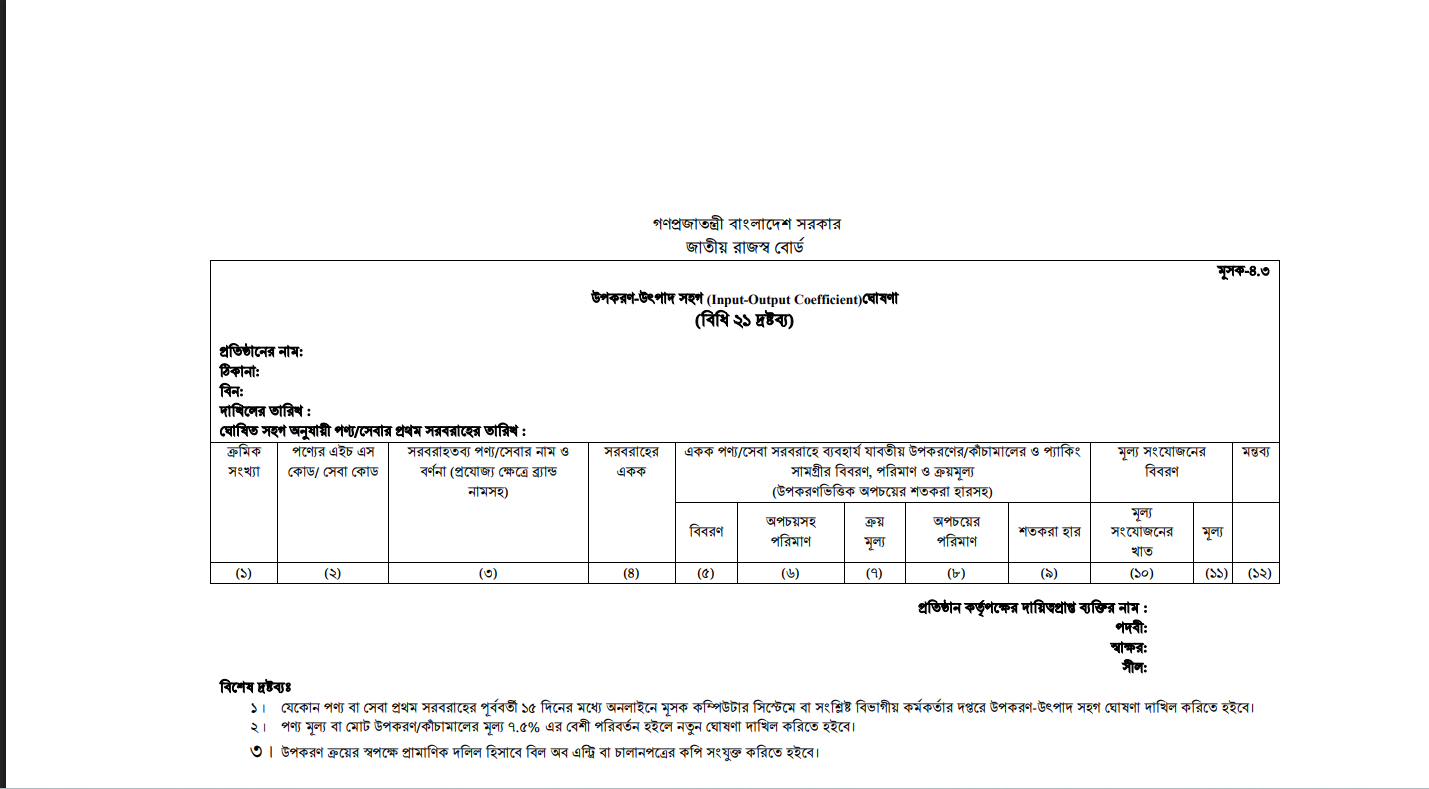

Mushak-4.3, or Price Declaration, is a mandatory VAT form that businesses in Bangladesh must submit to declare product prices to the National Board of Revenue (NBR). Kamal Associates BD must accurately prepare this form, detailing cost breakdowns, profit margins, and final prices of goods or services.

Mushak-9.1 is the monthly VAT return form that businesses like Kamal Associates BD must prepare and submit to the National Board of Revenue (NBR). It includes details of sales, purchases, input-output VAT, and tax adjustments. Accurate preparation ensures proper tax calculation and avoids penalties.