About Us

Welcome to the Kamal & Associates Website.

Our website is designed to provide comprehensive and up-to-date information about VAT, Tax, and Customs regulations in Bangladesh.

We understand that navigating the complex world of taxation can be challenging, especially for small business owners and individuals. That’s why we are committed to offering you or your organization clear and accessible information and resources to help you operate your business in compliance with Bangladesh’s VAT, Tax, and Customs laws.

With over a decade of reputable service, our team of experts has been delivering assistance in matters related to VAT, Tax, and Customs laws in Bangladesh. Kamal & Associates is managed by experienced professionals.

We strive to keep the Kamal & Associates website updated according to both the ol...

More InfoOur Services

E-BIN Registration(BIN).

Electronic Business Identification Number (E-BIN) registration is essential for businesses in Bangladesh to operate legally and engage in VAT-related activities. Kamal Associates BD must obtain an E-BIN through the National Board of Revenue (NBR) by applying online via the VAT Online System.

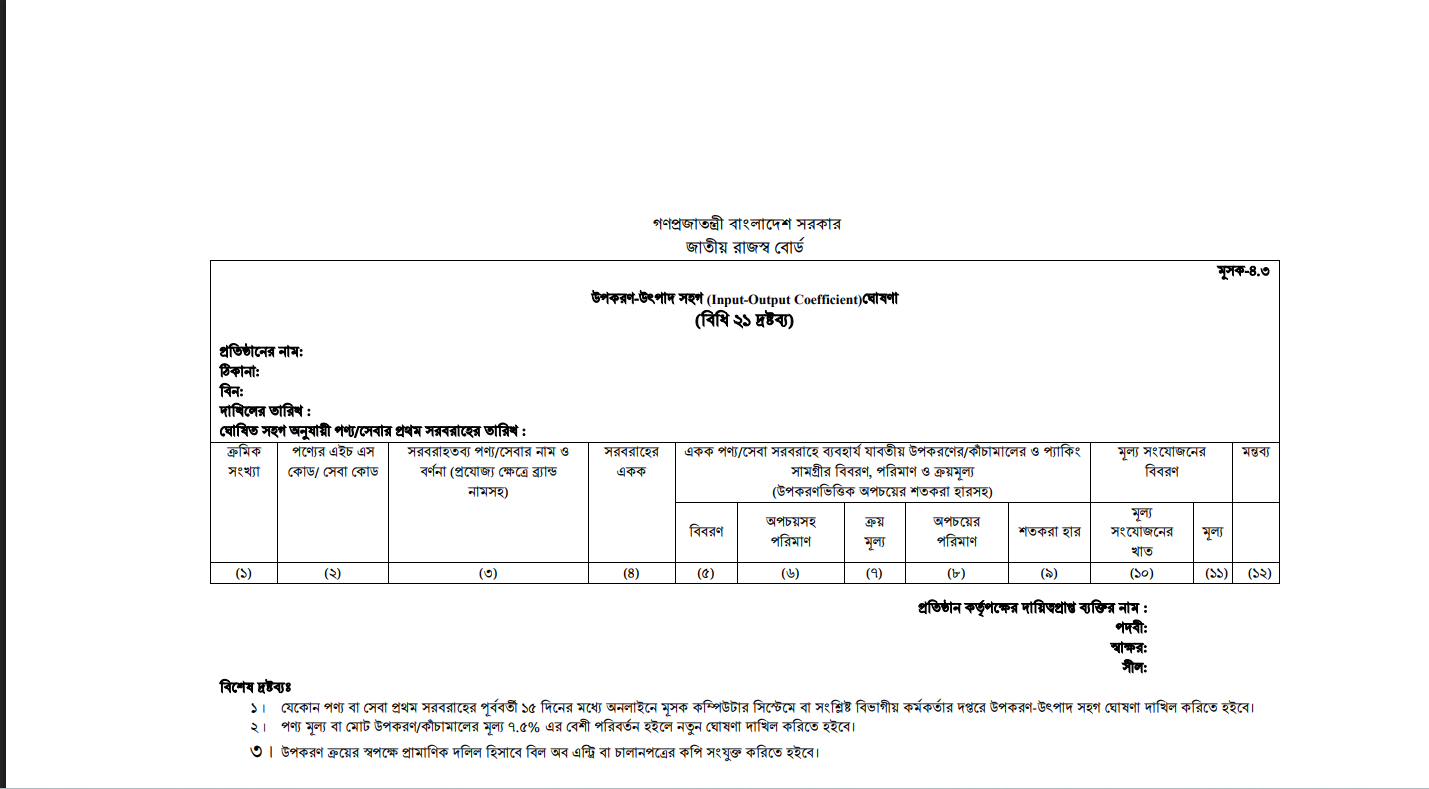

Price Declarations(Mushak-4.3) Preparation and Submit.

Mushak-4.3, or Price Declaration, is a mandatory VAT form that businesses in Bangladesh must submit to declare product prices to the National Board of Revenue (NBR). Kamal Associates BD must accurately prepare this form, detailing cost breakdowns, profit margins, and final prices of goods or services.

VAT Return (Mushak-9.1) Preparation and Submit

Mushak-9.1 is the monthly VAT return form that businesses like Kamal Associates BD must prepare and submit to the National Board of Revenue (NBR). It includes details of sales, purchases, input-output VAT, and tax adjustments. Accurate preparation ensures proper tax calculation and avoids penalties.SRO

E-TIN Registration(TIN)

E-TIN (Electronic Taxpayer Identification Number) registration is a vital step for Kamal Associates BD to operate legally in Bangladesh. Issued by the National Board of Revenue (NBR), the TIN is required for tax filing, bank account opening, trade licenses, and other official purposes.

Income Tax Return Preparation & Submit

Preparing and submitting an income tax return is a yearly obligation for Kamal Associates BD to ensure compliance with the Income Tax Ordinance of Bangladesh. The return includes details of income, expenses, assets, and applicable taxes. Accurate documentation and calculation are essential to avoid penalties.

Income Tax Audit, Case and Hearing

Income tax audits, cases, and hearings are part of the compliance process conducted by tax authorities to verify the accuracy of tax returns submitted by Kamal Associates BD. During an audit, officials may review financial records, bank statements, and business transactions.Why Choose Us

Trusted Expertise

With years of industry experience, our team offers professional, reliable, and accurate services tailored to your business needs. From tax compliance to VAT filings, we ensure every step is handled with precision, giving you peace of mind and allowing you to focus on growth.

Personalized Service

We understand every business is unique. That’s why we provide customized solutions that align with your goals. Our dedicated support ensures timely submissions, compliance assurance, and strategic guidance